AI-Powered KYC & KYB Platform for Financial Institutions

A global fintech company needed to streamline customer and business onboarding, ensure regulatory compliance, and reduce fraud risk. Their manual processes were slow, error-prone, and costly, leading to delays and a poor customer experience.

VIA partnered with the client to design and implement a scalable, AI-driven KYC (Know Your Customer) and KYB (Know Your Business) platform that automates identity verification, business validation, and compliance workflows.

Get started today, register or request a demo to see the platform in action.

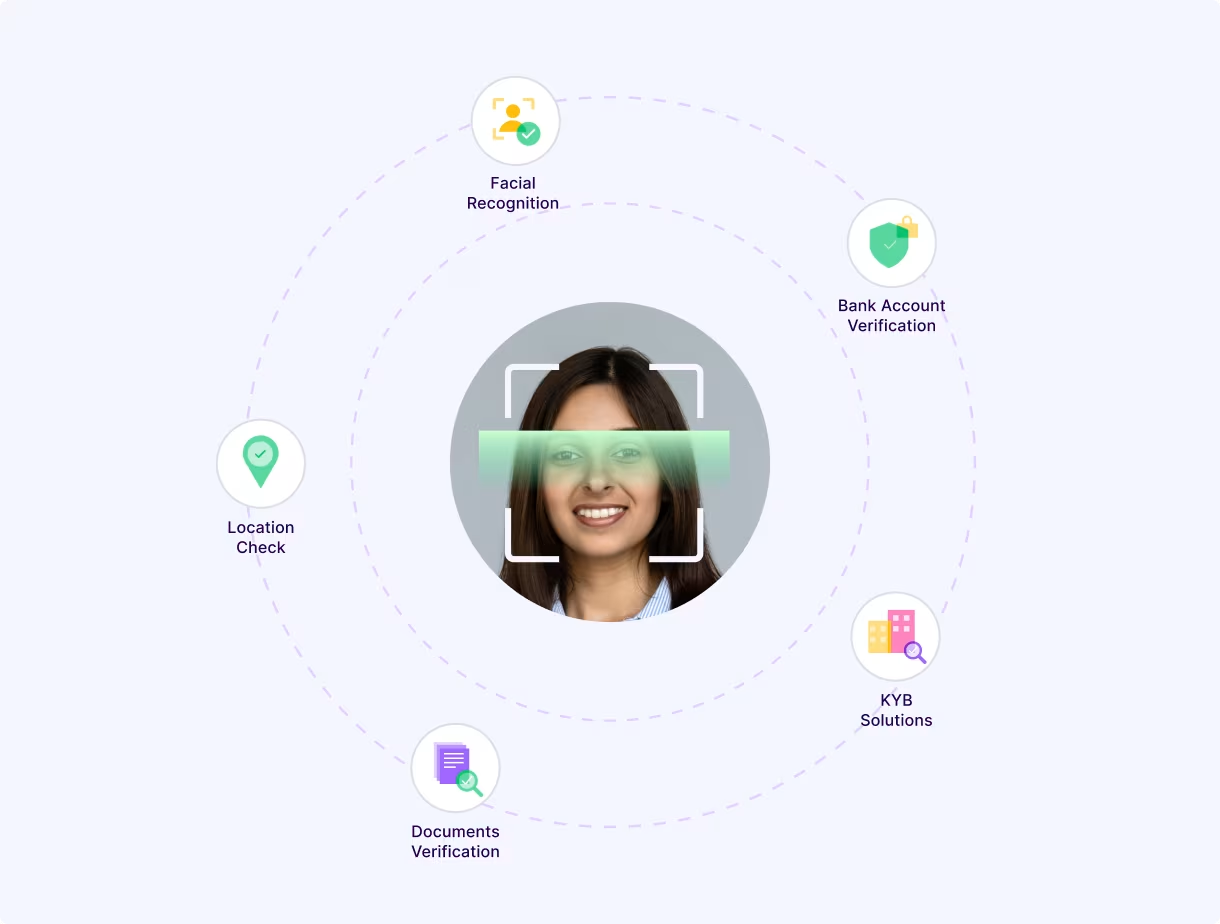

Streamline onboarding with our AI-powered KYC and KYB platform. Instantly verify identities and businesses using advanced OCR, facial recognition, and intelligent risk scoring. Automate compliance, reduce fraud, and accelerate customer activation in minutes, not days. Seamlessly integrate with your core systems via flexible APIs while staying compliant with AML, GDPR, and global regulations. Scalable microservices architecture ensures reliable performance as you grow.

Connect to us

Objectives

❓ Automate document verification and data extraction to accelerate onboarding

❓ Improve fraud detection with AI-powered risk scoring

❓ Support multi-jurisdiction compliance (AML, CFT, GDPR)

❓ Integrate with core banking and CRM systems

❓ Provide real-time analytics and audit trails

Solution Architecture

VIA delivered a microservices-based platform combining computer vision, NLP, and rule-based workflows:

✅ Core Components:

-

AI Document Verification:

-

OCR and deep learning models extract and validate information from identity documents, business licenses, tax certificates, and proof of address.

-

Supports passports, ID cards, utility bills, corporate filings.

-

-

Facial Biometrics:

-

AI face matching compares selfies to ID photos to confirm liveness and authenticity.

-

-

Entity Resolution & KYB Checks:

-

Cross-references company data against global registries and watchlists (sanctions, PEP, adverse media).

-

-

Risk Scoring Engine:

-

Machine learning models assign dynamic risk scores based on identity features, location, behavior, and historical data.

-

-

Workflow Orchestration:

-

Automates approvals, escalations, and notifications across compliance teams.

-

-

Audit Logging:

-

Immutable logs for regulatory reporting and traceability.

-

✅ Technology Stack:

-

OCR & NLP: Tesseract, spaCy, custom CNN models

-

Facial Recognition: OpenCV + proprietary liveness detection models

-

Backend: .NET Core, Python microservices

-

Database: PostgreSQL, Elasticsearch for search and indexing

-

Frontend: Angular dashboard

-

Messaging: Kafka for real-time event streaming

-

Cloud: Azure with containerized services

Implementation Approach

1. Discovery & Compliance Mapping:

-

Gathered all regulatory requirements (EU AMLD, FATF, regional KYC rules).

-

Defined risk scoring criteria with compliance officers.

2. AI Model Development:

-

Trained OCR and face recognition models on diverse datasets.

-

Developed custom entity resolution logic for KYB.

3. Platform Development:

-

Built microservices for onboarding, verification, risk assessment, and reporting.

4. Integration:

-

Connected APIs to core banking systems and CRM.

-

Enabled webhook notifications for downstream systems.

5. Testing & Certification:

-

Conducted UAT with compliance teams.

-

Passed external audits for security and regulatory adherence.

Results

❤️ 80% reduction in onboarding time (from days to minutes)

❤️ 90%+ accuracy in automated document verification

❤️ Significant fraud prevention improvements using AI-based liveness and cross-checks

❤️ Compliance readiness across 20+ jurisdictions

❤️ Improved customer experience, driving faster activation and higher satisfaction

Key Takeaways

This project shows that AI and microservices can modernize KYC/KYB, delivering:

-

Faster onboarding

-

Lower fraud risk

-

Better compliance

-

Scalable, API-first architecture for growth